Revitalize Your Life by Reviewing Life Insurance

Spring is a time for renewal—not just for your closets but also for your financial well-being. While you declutter your living space, consider refreshing your life insurance policy to ensure it aligns with your evolving needs. This proactive step can bring peace of mind and security for the future. Let’s explore four key areas to examine during your life insurance review.

Check Your Beneficiaries

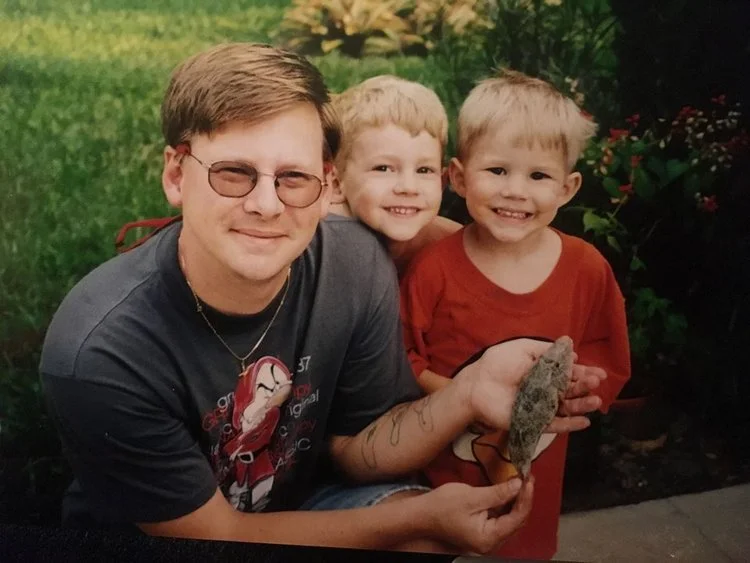

Keeping your beneficiaries updated is crucial. Life changes such as marriage, divorce, or the birth of a child can impact whom you want as the recipients of your life insurance benefits. Adjusting beneficiaries to reflect current relationships and financial goals ensures your intentions are honored. For instance, you might add children or establish a trust to provide structured inheritance. Doing so affords clarity and peace of mind knowing the benefits will reach the right individuals.

Evaluate Life Changes

Major life milestones often necessitate a close review of your life insurance. If you’ve recently married, welcomed a child, changed jobs, or purchased a home, your financial responsibilities have likely increased. These changes mean your coverage may need updates to support new commitments, such as a larger mortgage or additional dependents. Ensuring your coverage matches your life circumstances keeps your family financially secure.

Ensure Your Death Benefit Is Adequate

It’s essential to assess whether your current death benefit covers your growing financial needs. Consider factors like funding your children's education, managing a bigger mortgage, or adjusting to increased living costs. Reviewing your policy to ensure adequate coverage can provide enhanced financial security, particularly if your financial obligations have grown.

By revisiting and revitalizing your life insurance policy this spring, you are taking meaningful steps towards securing your financial future. If you have any questions or need assistance reviewing your policy, don’t hesitate to reach out to us. We're here to help ensure your coverage meets your needs today and tomorrow.